Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

This column aims to cover low-risk yield strategies (Odaily Note: code risk can never be eliminated) in the current market, primarily based on stablecoins (and their derivative tokens), to help users who wish to gradually amplify their capital scale by U-based wealth management find relatively ideal interest-earning opportunities.

Past Records

《Lazy Man's Financial Restart|Ethereal Earns 27% APR While Farming Points; Huma Opens New 28% APY God Pool (January 6)》;

《Lazy Man's Financial Guide|Cap's New Pool APY Rises After Announcing Stablecoin Airdrop; hyENA Increases LP Quota (January 22)》.

Exchange Wealth Management

The hottest wealth management opportunity at the moment is undoubtedly Binance's recently topped-up USD1 holding subsidy activity.

On January 23, Binance announced it would launch an airdrop event for eligible users holding USD1 on the platform. The event period is from January 23 to February 20, with a total prize pool of $40 million equivalent in WLFI. Eligible users need to hold a USD1 balance in any Binance account category (including spot account, funding account, margin account, U-based contract account, with contract or margin accounts eligible for a 1.2x reward multiplier). During the event, WLFI rewards will be distributed weekly to users holding USD1. The first airdrop will be distributed on February 2, covering rewards from January 23, 8:00 to January 30, 8:00. Subsequent rewards will be distributed every Friday.

A simple calculation of the yield situation suggests the result might not meet general market expectations. Overall, there are two main variables: one is the total value of the WLFI prize pool; the other is the total amount of USD1 within the Binance platform.

First, the total WLFI prize pool should be a fixed value of $40 million. However, this morning World Liberty Financial transferred 235 million USD1 from its treasury address to Binance, worth approximately $40 million, which is expected to be the total prize pool for this airdrop event. Therefore, over the next month, the total value of this prize pool will fluctuate with the price of WLFI. Considering the current downward market trend and the selling pressure from the airdrop rewards themselves, I lean towards the total prize pool value shrinking somewhat.

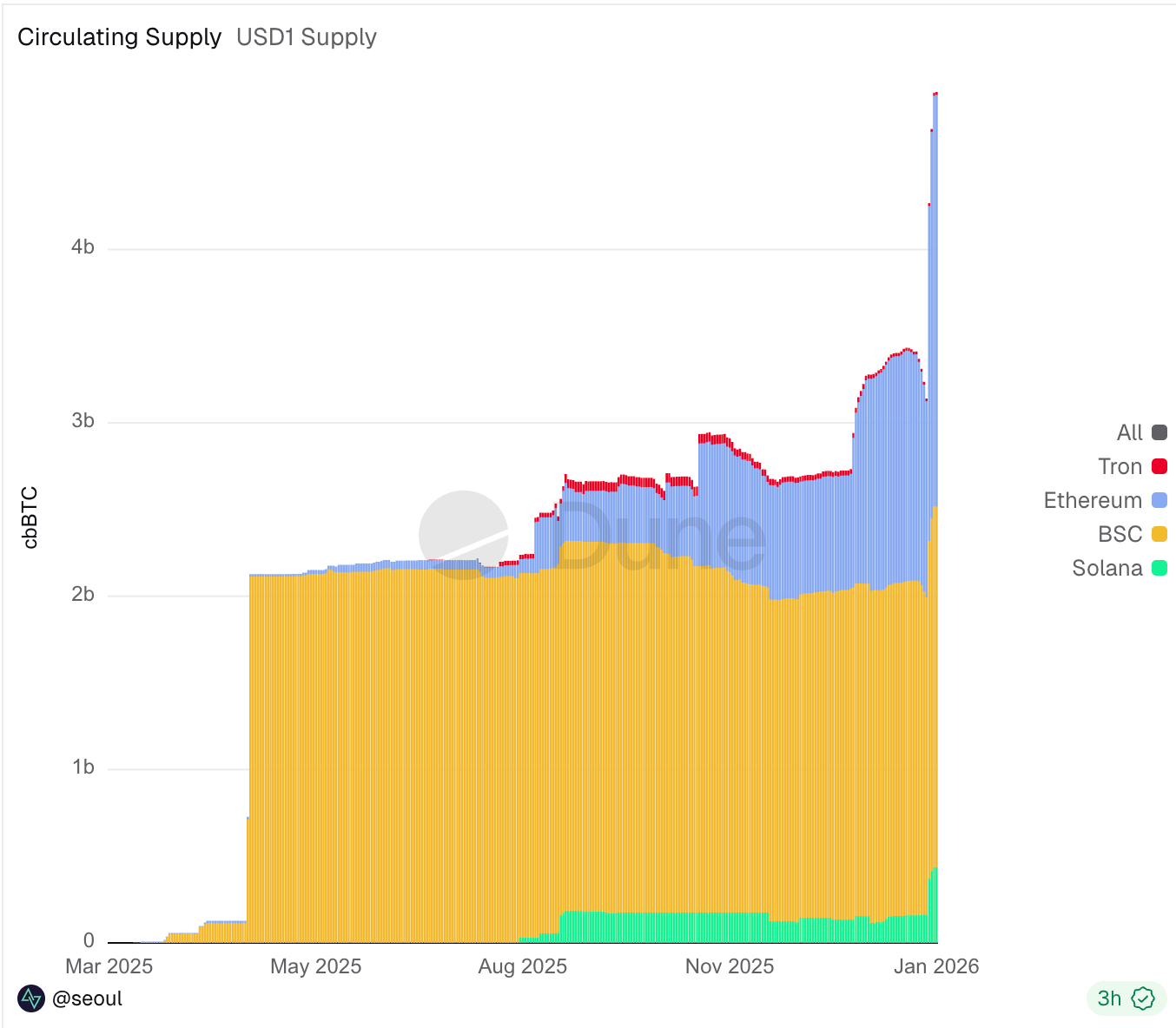

As for the total amount of USD1 within the Binance platform, the total issuance of USD1 has reached 4.9 billion coins, with about 4.22 billion located within the Binance platform. Statically calculating with this data, the average annualized yield for this event is about 12%. The problem is, since Binance launched this activity, the supply growth rate of USD1 has been very dramatic — nearly 700 million coins have been added since January 23, and the newly issued USD1 will basically flow into Binance, which will inevitably accelerate the dilution speed of the overall yield.

Considering these two variables, I tend to believe the average yield of this event will quickly dilute to below 10%, and a final expectation of around 8% might be relatively reasonable. Based on this standard, unless you already hold USD1 (or stablecoins like USDC with a higher premium than USDT), entering the market at a premium (e.g., buying USD1 with USDT at the current premium) is no longer cost-effective.

On-Chain Strategy One: ListaDAO U/USDT LP Incentives (21.29% APY)

This morning, the mainstream BSC lending protocol ListaDAO announced a LP deposit incentive activity for the stablecoin U in cooperation with Binance Wallet.

Specifically, users need to participate through Binance Wallet. The event time is from January 26, 8:00 to February 9, 8:00 Beijing Time. The participation method is depositing U/USDT LP (depositing both U and USDT simultaneously) via Smart Lending into ListaDAO. ListaDAO will provide 240,000 LISTA as incentives, with a current APY of about 21.29%.

On-Chain Strategy Two: OpenEden PRISM Pre-Deposit (26.4% APY)

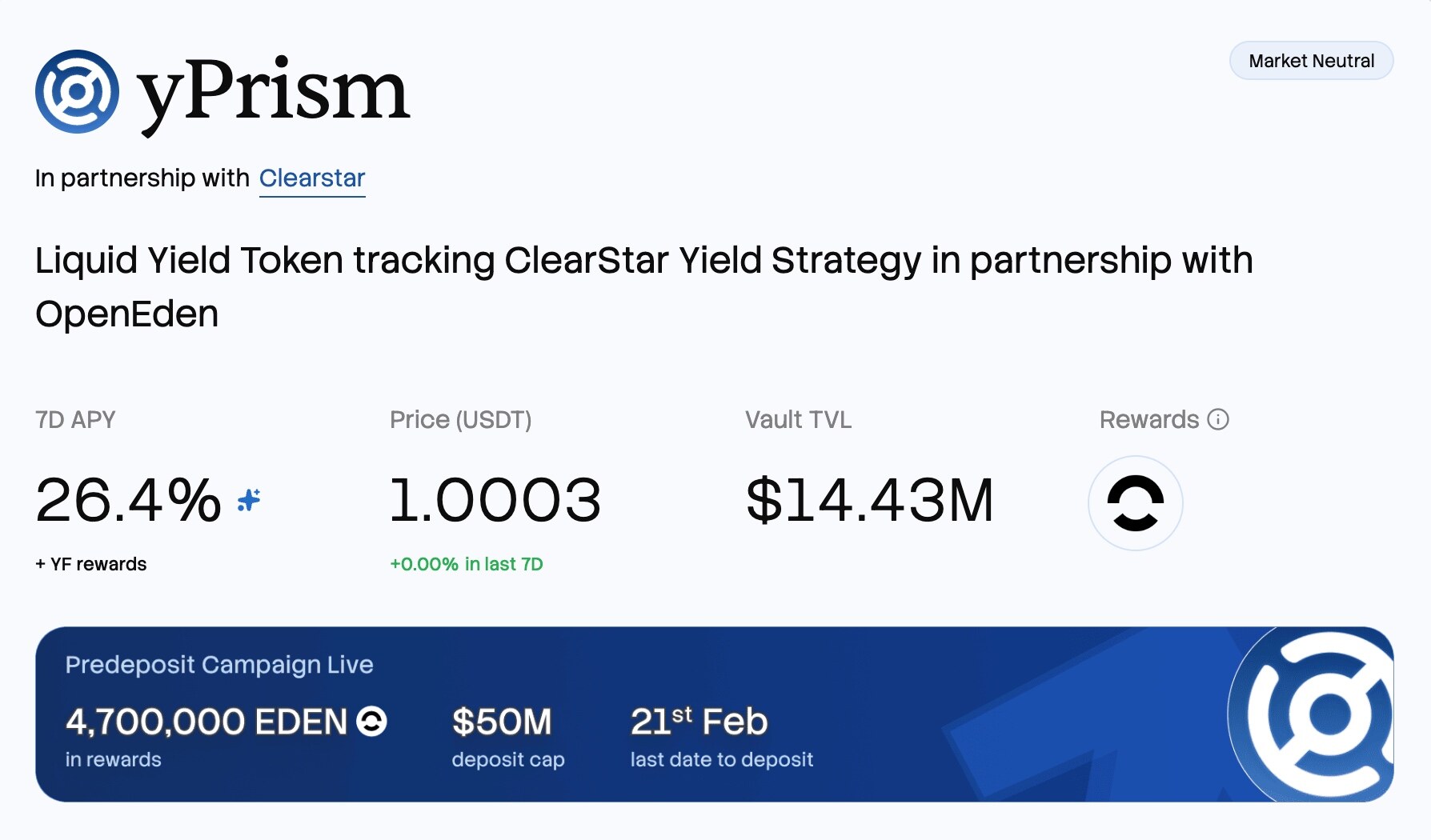

On January 23, OpenEden announced on platform X, in conjunction with FalconX and Monarq, the upcoming launch of the tokenized yield investment portfolio PRISM. This product aims to seek stable returns through a multi-strategy quantitative model actively managed by Monarq, maintaining low correlation with cryptocurrency prices across market cycles.

PRISM will officially launch in February, but pre-deposits are now open. The pre-deposit limit is $50 million, and $14.43 million has been deposited so far, leaving significant space. OpenEden will provide 4.7 million EDEN for pre-deposits, with a current real-time APY of about 26.4% (mainly from additional token incentives).

On-Chain Strategy Three: Buidlpad Vault Phase 2 (8% APY)

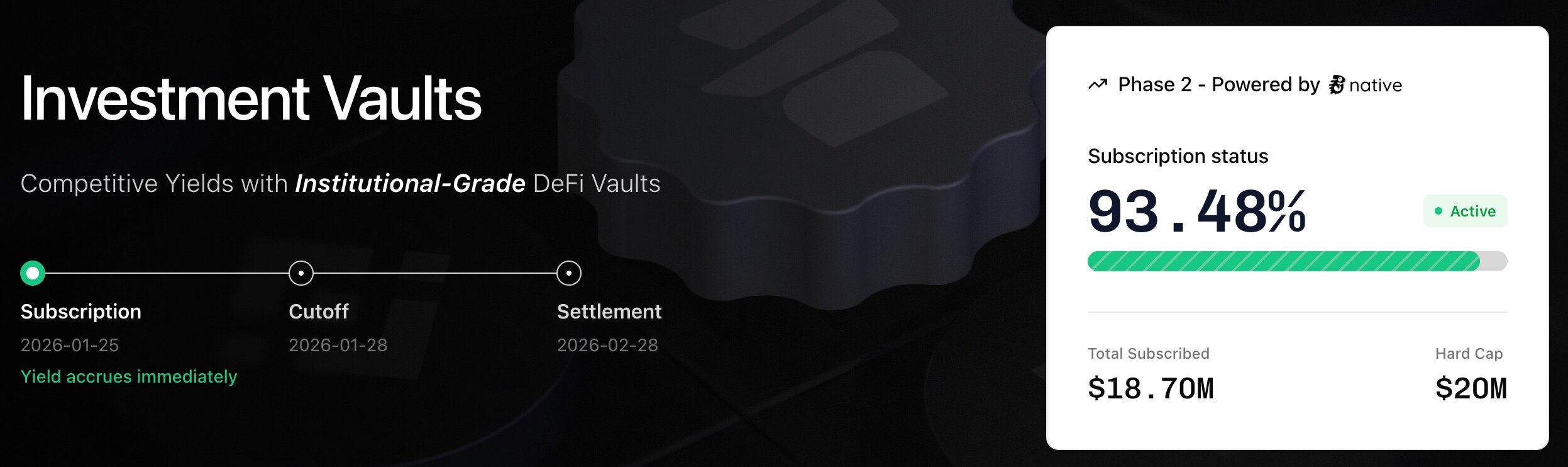

On January 24, Buidlpad announced the launch of the second phase of its DeFi fixed deposit product, Buidlpad Vault, offering an 8% fixed return. This phase's deposit opened at 8:00 UTC on January 25, with a limit of $20 million. It supports ETH and USDT on Ethereum, and BNB and USDT on BSC. The quota is $20 million.

As of writing, $18.7 million has been deposited into this pool, with a small amount of quota still available for participation.